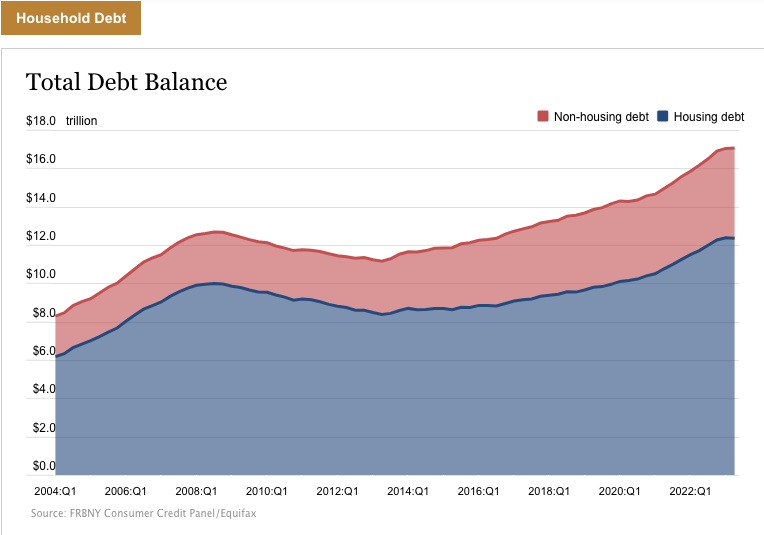

All, if not most homeowners in America secure a 30 year mortgage on their home(s). This is very standard and then most homeowners will either sell their home [to move into something else] or refinance to consolidate debt. Now we know this happens [nationwide] approximately every 5 to 7 years. What is the problem with this, you may ask? Well, glad you did ask and here is why - The lenders bank or plan on this in order to make the most of their dollars being loaned out because the cycle restarts each time a new home is purchase or refinanced for the homeowners, therefore alway [perpetually] putting off the day they or you can pay off the mortgage, henceforth retiring with "debt".

We have many clients that have learned that this madness can end by merely and simply "MARRYING THEIR HOME AND DIVORCING THEIR DEBT".....stop refinancing to lower a rate, end up with a lower monthly payment, or consolidating your consumer debt under the umbrella of your home mortgage.

Learn what many have already learned and that is how to pay off our mortgage in 5 to 7 years without spending a dollar more than you are already spending.

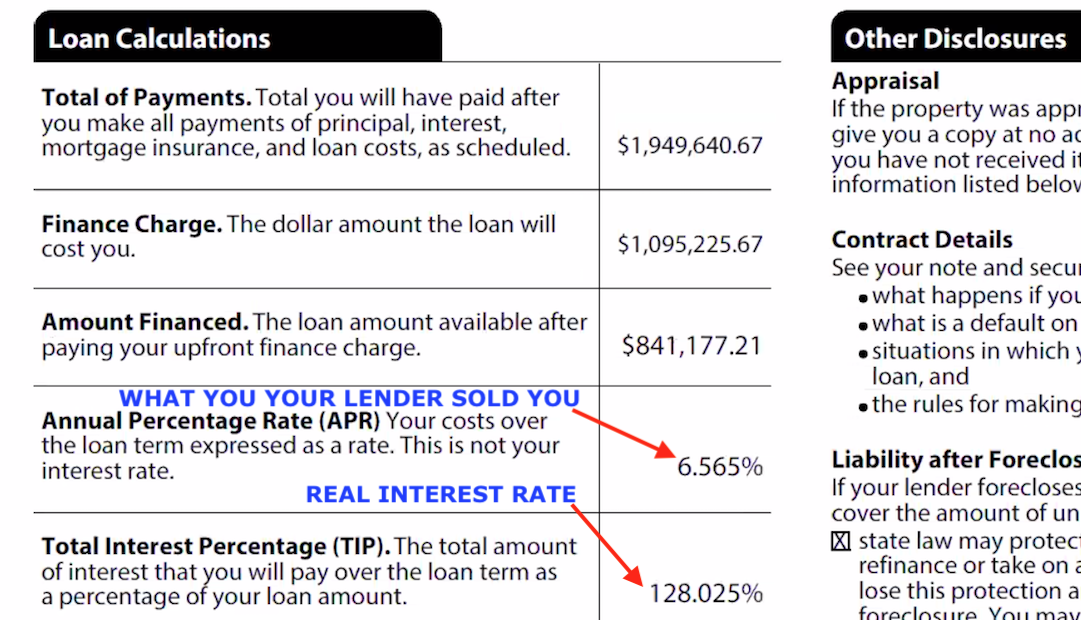

MOST IMPORTANT THING YOU CAN LEARN IS WHAT IS THE "REAL" INTEREST RATE YOU ARE PAYING YOUR LENDER FOR YOUR CURRENT MORTGAGE???????

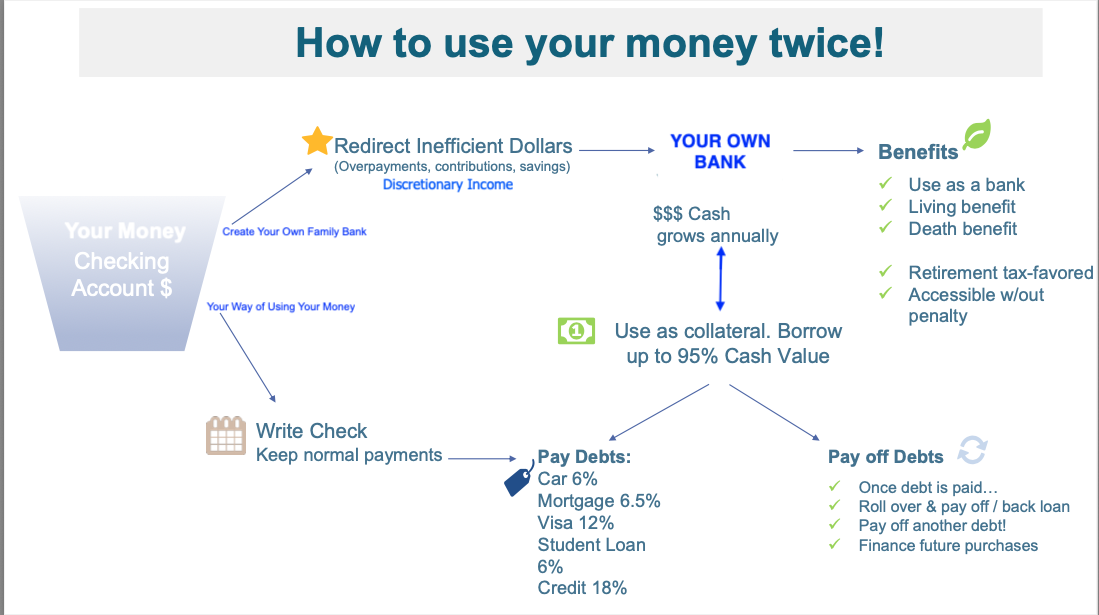

Although we can eliminate the consumer debt in two years or less on average and create a short-term impact, the real power of guaranteed continuous uninterrupted compounding is created for long-term wealth generation long after all the debt is gone.

So, what are the long-term benefits?

· Earning interest while we have use and control of our money

· Guaranteed wealth creation from money we are already spending

· Dividend generation on an increasing account

· Protection against unforeseen financial circumstances

· Insulation from means-tested qualifications

· Living benefits that become increasingly important with age

· Permanent death benefit for the WHEN not IF

Financially successful people always have a long-term plan for their money even though they have short-term needs.

We can customize a plan that eliminates all your debt

and builds guaranteed wealth in your sleep!

Give us a call today to learn how to put you in a position of certainty for your future!!!